A Powerful Course Teaching First Home Buyers,

Current Homeowners & Property Investors.

How To Buy Property In The Right Entity & Structures,

BEFORE You Buy To Mitigate Risk.

You'll Learn...

- 10 Basic Mindshifts To Help Shape Your Financial Decisions & Behaviours.

- How To Estimate How Much Passive Income You'll Need By Retirement.

- How To Leverage Your Existing Equity To Build Your Property Portfolio Faster.

- The Different Entities Which You Can Buy Your Properties In.

- What Property Taxes Exist In Australia & When These Will Be Applicable.

- How To Protect Your Property Assets From Lawsuits & Unexpected Situations.

- How Your Property Assets & Estate Will Be Dealt With Upon Your Death.

- What Finance Lenders Want To Improve Your Chances Of Gaining Loan Approval.

- How Property Market Cycles & Economic Indicators Affect Property Performance.

- How To Formulate Your Property Strategy To Meet Financial Goals.

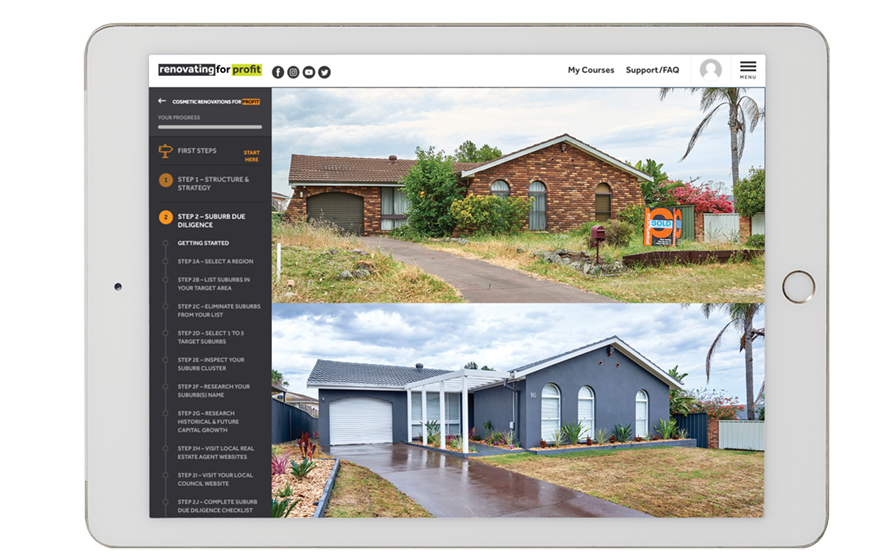

This Course Includes:

- 11 Video Lessons.

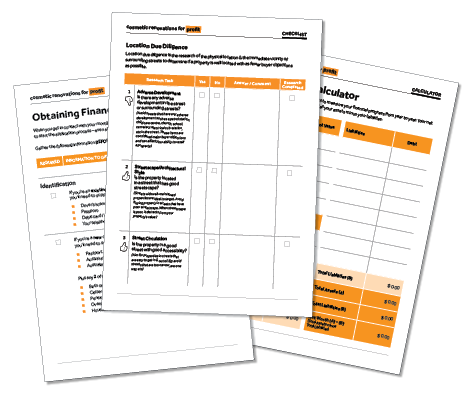

- Passive Income & Equity Calculator.

- Downloadable Course Notes.

- Downloadable Course Workbook.

An Essential Course For Anyone Buying Property

Anyone can buy a property but not everyone does so smartly. Most Aussies don’t ever take the time to educate themselves on what you should do BEFORE you buy your very first property.

By default, a large chunk of Australians buy their first property in their own personal names, putting themselves at incredible risk in the event of lawsuits or unexpected life events. This can be totally avoided, simply by buying your property in the right entity from the outset, to minimise risk. This course explains what you need to consider & do to take control of your property assets.

Success Doesn’t Happen Without A Strategy

Investing in property ain’t cheap & it’s not something you want to get wrong. It’s proven that individuals who take the time to sit down & think through their property strategy first, are far more likely to achieve a greater level of property success.

In order to formulate a property strategy (suited to your own individual circumstances), you’ll need a greater appreciation of your passive income goals, property market cycles, economic indicators & your current equity position to name a few. Through consideration of these things, you’ll be able to build your property portfolio in a more sound, strategic way at an accelerated rate.

Unfortunately, most Aussies don’t do their property strategy first, instead buying property flippantly or for emotional reasons, resulting in the wrong types of property, in the wrong locations being acquired that underperform & cause financial stress. This can all be avoided by understanding how to formulate your property strategy first, before you buy.

Lifetime Access For $385.00 Only.

Here’s What You’ll Learn.

If you’re keen to build a property portfolio, you’ll know that investing in property is a huge financial decision that will require you to have the right money mindset from the very start of your property investing journey.

In this lesson, learn 10 basic mind shifts to help shape your financial decisions & behaviours, thereby leading to more effective property investing decisions. A positive money mindset will also encourage you to think constructively about wealth, viewing challenges as opportunities for growth, rather than obstacles. This will help you be more effective in setting & achieving your property financial goals.

Moreover, a healthy money mindset impacts your overall well-being. It reduces stress associated with financial issues & promotes a more balanced life. By understanding the value of money & its role in your life, you’ll have a greater level of financial confidence & peace of mind, enabling you to navigate the complexities of the property investing world with greater ease and success.

Passive income is the holy grail of property investing. In this lesson, learn exactly what passive income is, how it works, its importance in your wealth creation journey & how it should ultimately shape many of your property investing decisions for the remainder of your working life. Master how you calculate it & align your property strategy to it.

The more passive income you build & the sooner you achieve it, the more financial security & freedom you’ll have, reducing the need to work later in life & be dependent on a traditional 9 to 5 job. This type of income will also be your fallback position to help cushion you against unexpected life events such as job loss or health issues that can disrupt your ability to earn money.

Understand what equity is & how to calculate it which is one of the fundamental cornerstones of property investing. Learn how to successfully leverage any existing equity you already have to build your property portfolio, without physically having to save a deposit for each property thereafter (after your initial property purchase).

In this lesson, you’ll gain an appreciation of the different types of equity available & how you can use it to accelerate the growth of your property portfolio & therefore build wealth faster over time. You’ll learn how equity can improve cash flow & mitigate your risk against market downturns that ultimately help you build a more robust & profitable property portfolio.

Learn which real estate professionals you’ll lean on for supplementary property advice, throughout your property investment journey.

Investing in property is a significant financial decision that carries both potential rewards and risks. In this lesson, you learn which professional advisors you should consult, before you buy your very first property. These advisors will have specialist knowledge in their area of expertise, enabling you to make more informed decisions about your property portfolio, particularly relating to local laws, tax implications & the like. Professional advisors will also offer 1:1 advice, taking your individual circumstances into account, your long-term goals & risk tolerance.

In Australia, property taxes are an important consideration for anyone looking to purchase property. Certain property taxes may be applicable to your project & this lesson discloses them all, particularly if you intend to do the ‘buy & renovate” strategy after purchase.

Learn what property taxes you’ll need to consider & how these taxes differ in every state of Australia based on factors such as your location, property value or whether you’re a first home buyer or not. You’ll learn whether these taxes are a 1-off payment or ongoing taxes, crucial information for you to know so you’re fully informed about the ongoing costs associated with your investment.

Estate planning is a critical process that involves organising & managing your assets (including property) to ensure your assets are distributed according to your wishes after your death. In the world of property, failing to have a proper estate plan in place can affect the distribution of your assets, have tax implications, encounter jurisdictional challenges with varying laws thereby presenting legal challenges for the beneficiaries of your estate.

In this lesson, you’ll learn some of the key things you’ll need to consider in formulating an effective estate planning strategy to ensure your assets (including property) are transferred smoothly, minimising the burden on loved ones during a difficult time. You’ll also gain insights into which entities may be best for you to buy your properties in.

Failing to get the right structures in place prior to exchanging on a property, may result in a need to change your property ownership details, triggering the need to pay the substantial costs of stamp duty again. By engaging in estate planning (before you buy a property), property owners can safeguard their legacy, provide for their loved ones & have peace of mind knowing their property affairs are in order.

Having an asset protection plan in place (from the start of your property journey) is crucial for safeguarding your wealth & financial stability. In today’s unpredictable economic climate, individuals & businesses are increasingly vulnerable to various risks, including lawsuits, creditors & bankruptcies. Without a robust asset protection strategy in place, your hard-earned assets could be exposed to these threats, potentially leading you to loss of those assets.

In this lesson, learn key insights into what asset protection is, why it’s essential to have & the core components of what makes up an effective asset protection strategy. Doing so will put you in the best position to not lose your hard-earned property assets, but also comes with the added bonus of helping minimise your annual tax obligations.

To buy property, you’ll often need to secure finance. Successful property investors don’t chase loans on a one-off basis. They’ll get a robust finance strategy in place which is essential if you want to buy property on a more continual basis. Access to finance therefore becomes a key enabler, allowing property investors to leverage their capital & increase their purchasing power.

In this lesson, gain a greater appreciation of some of the key ins & out of the finance world by a top Australian mortgage specialist. You’ll understand what banks essentially want & which lenders are easier to borrow money from. You’ll gain an insight into certain finance dynamics such as interest rates, how you can best position yourself to increase your chances of loan approval (not a decline) & become smarter on how to structure your borrowing so it aligns with your long term property investment goals & risk tolerance.

As a property investor, you’ll need to understand how the property market cycle works as it significantly influences property values, investment returns & the overall success of your property portfolio. The property market goes through 4 key phases, influenced by a number of market dynamics & with an understanding of this, you’ll be able to make more informed decisions about when you buy, sell or hold your properties.

In this lesson, learn the 4 key phases of the property market cycle & the tell-tale signs to help you identity what phase the cycle is in, in your target locations. You’ll learn how to identify the lower end of the cycle so you buy at the optimal price & sell in the peaks to maximise your profits. Knowledge of how the property market cycles works will also help you anticipate changes in property values & rental yields (in advance) helping you capitalise on opportunities or mitigate your losses.

Understanding economic indicators is vital when buying property as these provide valuable insights into the overall health & direction of the global & Australian economy, which in turn, significantly impacts supply & demand for property in Australia & therefore its performance.

In this lesson, learn the 14 key economic indicators that influence property values in Australia & how these can help property investors identify potential growth areas or avoid certain regions facing economic challenges. By keeping a close eye on these indicators, property buyers can gauge the best times to enter or exit the market, predict future trends & make more informed investment decisions.

If your goal is to build a property portfolio, it’s probable it won’t happen by fluke. Having a well thought out property strategy (before you buy your first property ideally), will serve you well in the long run & ensure you don’t acquire property assets that don’t meet your long-term financial goals.

In this lesson, you’ll grasp the ways you can start to formulate a property strategy for yourself, taking your passive income goals & aligning those with a property strategy, individual to your own personal circumstances. Getting this strategy in place will help you identify the right types of property to acquire & the right locations, ensuring you don’t make flippant or emotional property decisions that may result in underperforming investments or, worse, financial strain. This lesson also contains a lot of strategy detail if you plan to buy & renovate a property in the future.

Prefer To Download A PDF Of The Full Course Curriculum?

Course Inclusions.

No fluff & jargon. This course is designed to help you take action.

11 Video

Lessons

Approximately 31/2 hours of deep dive, immersive video training.

Downloadable

Course Notes

Prefer learning by reading? We’ve got comprehensive course notes for you.

Passive Income &

Equity Calculator

Helps you calculate your current financial position, where you need to get to & how many properties you’ll need to buy.

Lifetime Access For $385.00 Only.

Your Course Experts

This course is delivered in conjunction with some of the property industry’s very best experts.

Be Trained By Cherie Barber –

Australia's Leading Expert On Renovating For Profit.

32

Years

Experience

Experience

175+

Renovations

Completed

Completed

75M+

In Property

Acquisitions

Acquisitions

TV

Personality

20K+

Students

Trained

350K+

Social

Followers

Followers

Cherie Barber took on her first renovation in 1991 (aged 21) whilst holding down her full-time job. One of her early cosmetic projects, netted her a massive profit of $268,000, earning her 4 years’ salary in the space of just 8 short weeks. With renovating being her life career, she’s now renovated 175+ homes, personally purchased over $75 million in property & has trained well over 20,000 students who now replicate her proven process.

Cherie is the only renovation expert who has been featured on every major Australian TV Network & has regularly starred in popular shows such as Channel 9’s ‘Space Invaders’, Channel 10’s ‘The Living Room’, Channel 9’s ‘Today Extra Show’ & her American series ‘5-Day Flip’. She’s been widely known as ‘Australia’s Renovation Queen’ since 2002, is Australia’s undisputed authority on how to Renovate For Profit & is an accomplished property investment expert who is a sought-after media contributor.

Who Should Do This Course?

Our Property Structure & Strategy Course is an excellent “foundations” course for the following types of people:

Individuals planning to invest in real estate who want to enhance their knowledge about structuring investments, strategic planning & protecting their assets, before they buy.

Individuals who already have their own home or investment properties who want to tighten up their property affairs in a more structured way to mitigate risk.

Those who want to deepen their understanding of the investment side of real estate to better serve their clients or manage their own investments.

Those managing properties for their clients who wish to have more detailed knowledge on how best to structure property assets for client risk mitigation.

Lifetime Access For $385.00 Only.

Optional Course Extras.

Want more? These optional extras can be added to your course at any time after you enrol.

Save thousands off a wide range of renovation fixtures & fittings you’ll need in your projects. Enjoy major national account status at all Bunnings stores nationally & phenomenal discounts off a stack of other suppliers who drop ship nationally. The savings that you get from this trade group will pay for your course, many times over.

RP Data is the leading data provider for property analytics. It offers:

- Property details – photos, official information & sales history.

- Suburb statistics & comparative market report – sales & rentals.

- Property valuation reports & property watchlists.

- Search by property, street, suburb & post code with aerial view of suburbs.

- Filter results by property type, land size, sale price & more.

What Students Say About This Course

We did Cherie Barber’s Renovating for Profit many years ago as a husband & wife team. As soon as we did the course, we got straight to work with our knowledge, purchasing and renovating a unit in Maylands. The course has been a godsend for us. We were able to renovate and rent 4 of our renovations, and we sold the 5th renovation. We were able to sustain great rental prices in the rental market all throughout the property market decline here in Perth. We have had a near 100% tenancy rate in all our properties, which we directly attribute to the gorgeous renovations we were able to complete using Cherie’s formulas. We even became an authority on renovating within our own personal sphere, offering advice and some of our discounts to friends and family who were doing their own personal renovations. If you love renovating and are looking for something that gives you the formula and style guides to follow, along with an awesome discount, definitely invest in your future with Renovating for Profit.

Incredibly informative down to minute detail for anyone wanting to learn how to renovate a property. Cherie is authentic, caring and highly supportive of all her students. Her team are second to none and are very accessible. I have had reason to call on Cherie's team on numerous occasions for help and have consistently gotten quality timely advice. I could not rate this training anymore highly.

I consider myself an experienced renovator and property investor but this course is next level. If I had done this years ago, my property portfolio would be much larger. Highly recommended for anyone wanting to secure their financial future through property and willing to roll up their sleeves.

Incredibly informative down to minute detail for anyone wanting to learn how to renovate a property. Cherie is authentic, caring and highly supportive of all her students. Her team are second to none and are very accessible. I have had reason to call on Cherie's team on numerous occasions for help and have consistently gotten quality timely advice. I could not rate this training anymore highly.

I consider myself an experienced renovator and property investor but this course is next level. If I had done this years ago, my property portfolio would be much larger. Highly recommended for anyone wanting to secure their financial future through property and willing to roll up their sleeves.

Cherie teaches you how to fish for life. I have been following Cherie for few years before I attended the Boot Camp in 2017. I have attended boot camp twice now. The material depth passion sincerity access to material and advice from team is indispensable and incomparable. I rate the boot camp and online courses more than a university degree as its sharp real life and you can apply right away. I thank and praise Cherie for her authencity and clean work ethic. Highly recommended. Best time and money invested.

The Renovating for Profit Course provides all the tools, information and support needed to build a strong foundation to move forward into the renovating business. I did not realise how little I knew until I started the course, but now am confident in building our property portfolio. Cherie’s knowledge she shares with her students is invaluable; and her positive enthusiastic attitude and genuine smile lights up everyone around her. HIGHLY RECOMMEND!! Thank you Cherie and your team 😁🥂

I joined the Cosmetic Renovations For Profit program in 2017. The course paid for itself with my first bathroom renovation! I have been renovating for profit ever since & making a great living out of it. I've already renovated three properties & am flipping one right now. Having studied many other courses on renovation, I can say with absolute conviction that Cherie's course provides the best value & is the most comprehensive renovation course on the Australian market. Thank you Cherie!

Cherie is a Dynamo, great course and all the information you need to become a professional renovator. If i’d only joined years ago when I first heard Cherie speak, I could have stream lined my renovating, and my portfolio would be much larger along with my equity and rental income. Highly recommended.

Previous

Next

Love The Course Or Get Your Money Back.

10-Day Refund Guarantee.

It’s a natural human reaction to wonder if this course is all it’s cracked up to be…

Will it really help you? We’ll give you 10 days to decide if it is.

In the first 10 days, jump head-first into the course to see how extensive & thorough it is. Watch no more than 25% of the video tutorials to see if the course meets your expectations. If you decide it doesn’t, simply email us within your first 10 days & we’ll refund your money.

Please be aware, to stop this guarantee being abused – if you watch more than 25% of the video lessons, download any of the course notes or the Passive Income & Equity Calculator, you’ll waive your right to a refund.

Lifetime Access For $385.00 Only.

Frequently Asked Questions.

You can enrol in the course at any time. We don’t believe in making you wait for a course intake to open, if you’re keen to start your property education straight away.

As soon as you enrol in the course, you’ll receive immediate access to all the lessons within the course. This can be particularly helpful if you’ve already started a project & need further education on some parts of the process.

If you fall behind in your study, don’t stress as you have lifetime access to the course, enabling you to study at your own pace.

You have lifetime access to the course for as long as Renovating For Profit continues to trade for business. You can jump in & out of the course as often as you like.

This course contains approximately 3.5 hours of video lessons, plus course notes. Most students watch all the video lessons & read all the course notes first, in the step-by-step sequence listed. Students then go back & actions all the steps again in greater detail. It therefore takes approximately 2 to 4 weeks to study & action all the recommended tasks within the course.

Sharing is caring but unfortunately not with this course. Renovating For Profit has invested heavily in online security. You’re able to access your course via 2 registered devices only – either a desktop computer (which we strongly recommend for optimal learning), laptop, IPAD or mobile. Renovating For Profit can detect fraudulent logins on your account. We are strict with this policy to prevent viral sharing of the significant assets that Cherie Barber has created in this course.

Absolutely, most people don’t buy their properties in the right entities or with the right structure in place until they are further along in their property investing journey. This is often not the best way to structure your assets. This course teaches you strong property foundation basics that could save you tens of thousands in avoiding mistakes.

This course is considered one of our micro-courses therefore 1 on 1 coaching support is not available due to the legalities of providing individual advice. The course however provides contact details of a range of professionals you may wish to engage to get your property affairs in order.

Still got questions? CLICK HERE to email us or call (02) 9555 5010

Property Structure & Strategy Course

$ 385.00